Stock Information

-

$

Open$Prev Close$$ Change$% Change%VolumeShares Outstanding52 Week High$52 Week Low$High$Low$Bid$Ask$Bid SizeAsk SizeLast TradeUpdated AtData delayed 15 minutes unless otherwise indicated. Market data powered by QuoteMedia. -

$

Open$Prev Close$$ Change$% Change%VolumeShares Outstanding52 Week High$52 Week Low$High$Low$Bid$Ask$Bid SizeAsk SizeLast TradeUpdated AtData delayed 15 minutes unless otherwise indicated. Market data powered by QuoteMedia. -

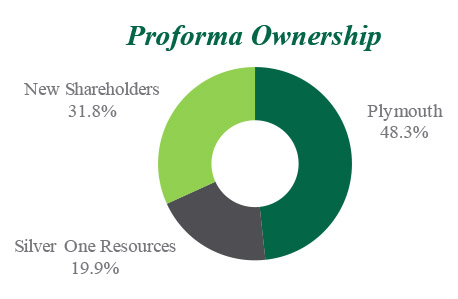

Proforma Capital Structure

Subscription Receipt Amount (C$M) $6.0 Subscription Receipt Issue Price (C$/unit) $0.80 Ownership Basic Shares # of Shares Ownership Plymouth (M) 11.4 48.3% Silver One Resources (M) 4.7 19.9% New Shareholders (M) 7.5 31.8% Total Capital Structure (M) 23.6 100.0% Pre-Money Equity Value (C$M) $12.9 Add: Gross Proceeds (C$M) $6.0 Post-Money Equity Value (C$M) $18.9 Less: Plymouth Cash on Hand (C$M) ($0.4) Add: Cash Obligation to Silver One Resources (C$M) $2.2 Total Corporate Adjustments (C$M) $1.9 Less: Gross Proceeds (C$M) ($6.0) Post-Money Enterprise Value (C$M) $14.7

- On March 3, 2021, Silverton has completed its previously announced "Qualifying Transaction" with the acquisition of three silver-focused Mexican mineral properties, being Peñasco Quemado, La Frazada and Pluton from Silver One Resources

- On January 8, 2021, Silverton, through Silverton Finco Inc. ("Finco"), completed its Brokered Private Placement for aggregate gross proceeds of $7,400,000

- On March 2, 2021, Silverton, through Finco, completed a Non-Brokered Private Placement for total proceeds of $1,859,200

- Each Warrant is exercisable to acquire one common share of the Resulting Issuer (a "Warrant Share") at a price of C$1.15 per Warrant Share for a period of 36 months from the Closing Date

- Use of Proceeds: Exploration, working capital and planned drill program of 11,000 m