Lodestar Battery Metals Files N.I. 43-101 Technical Report for the Peñasco Quemado Project Updated Mineral Resource Estimate

May 8, 2023VANCOUVER, BRITISH COLUMBIA – May 8, 2023, 2023 – Lodestar Battery Metals (“Lodestar” or the “Company”) (TSX-V: LSTR) Is pleased to announce it has filed the independent technical report for the Peñasco Quemado Project (“PQ” or the “Project”) updated Mineral Resource Estimate (“MRE”). The report titled “NI 43-101 Technical Report for the 2023 Mineral Resource Estimate on the Peñasco Quemado Project, Sonora, Mexico” is dated April 17, 2023 (with an effective date of March 21, 2023) (the “Technical Report”). The Technical Report can be found on the Company’s website (www.lodestarbatterymetals.ca) or under the Company’s issuer profile on SEDAR (www.sedar.com).

The Technical Report was prepared in accordance with National Instrument 43-101 (“N.I. 43101”) Standards of Disclosure for Mineral Projects by Micon International Ltd. (“Micon”) of Toronto, Canada. Highlights of the MRE include:

- 6.2 million ounces (“Moz”) silver classified as inferred (“inf”) at Peñasco Quemado with an average grade of 168.6 grams per tonne (“g/t”) silver.

- Conservative base-case estimate uses 85 g/t silver cut-off grade.

- Relatively low strip ratio of 2.25:1 for Peñasco Quemado resource.

- Future resource growth potential remains at Peñasco Quemado.

“We’re thrilled to have filed an updated 43-101 Technical Report for our Peñasco Quemado Project in Sonora, Mexico,” said Lowell Kamin, President, CEO & Chairman of the Board of Lodestar. “An updated Mineral Resource Estimate is important to show our investors and other key stakeholders that there’s legitimate value in our properties. We look forward to exploring our established resource zones as we continue to consider our diverse portfolio of Company assets.”

Peñasco Quemado Project Mineral Resource Estimate.

The 2023 MRE objective was to upgrade the historic Peñasco Quemado resource estimate to current standards under the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”). The most notable change in the 2023 MRE is the significant decrease in resource tonnage and a notable resource classification category limited to only inferred resources. The Peñasco Quemado resource now contains 6.2 Moz silver in 1.1 Mt at an average grade of 168.6 g/t silver in the Inferred category.

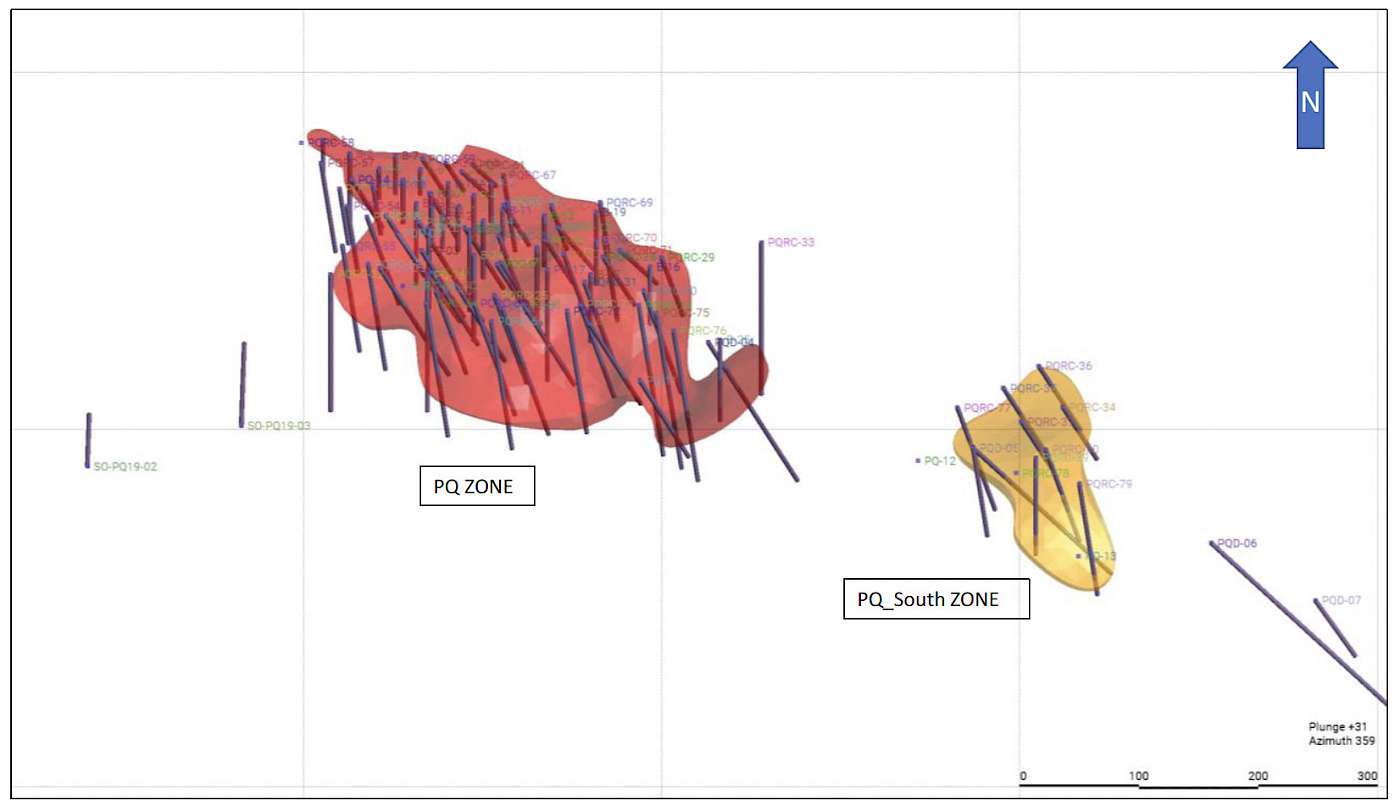

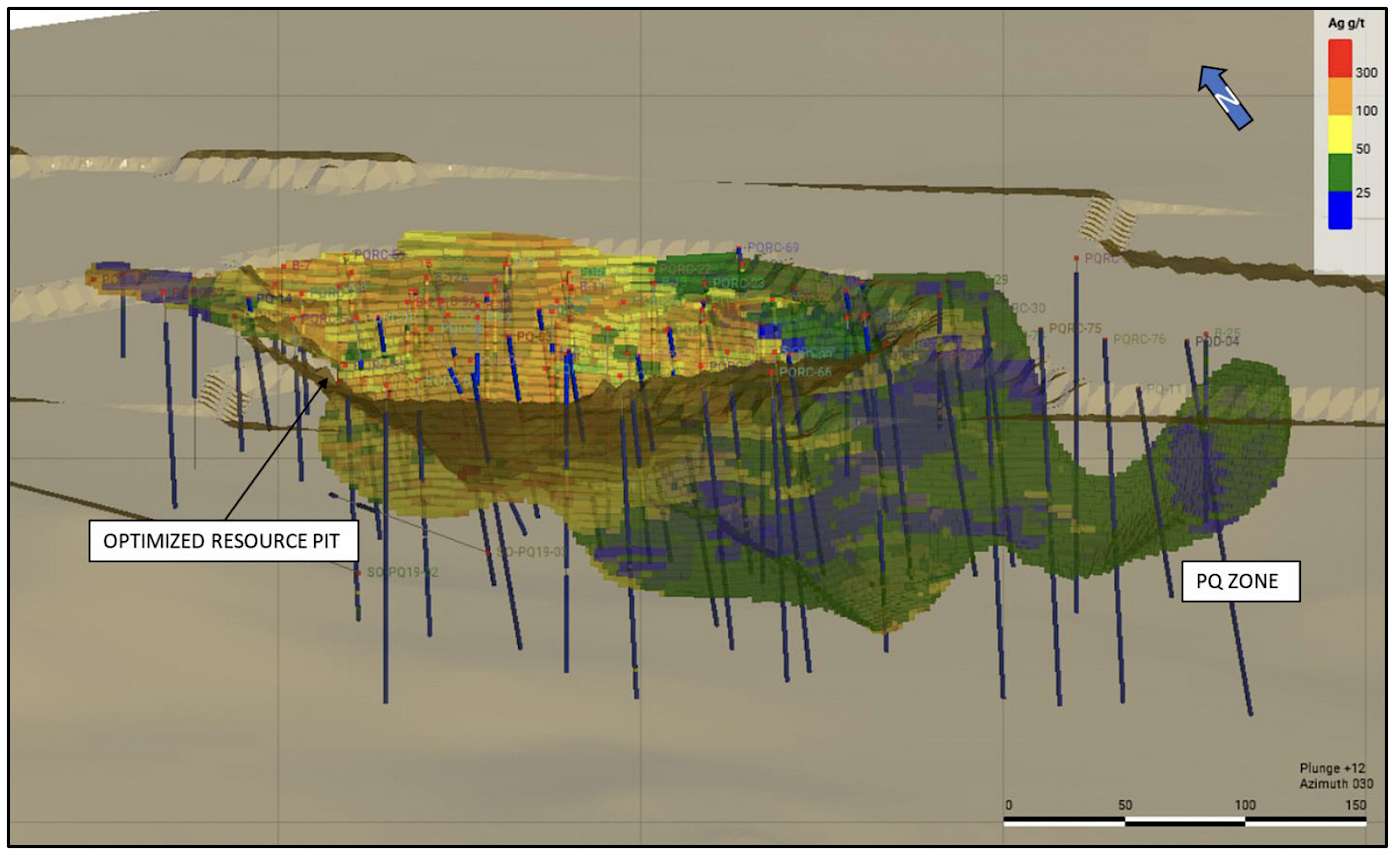

In addition to its defined silver resources at PQ mineralized zone, a separate pit was generated for the PQ South zone; however, this does not meet the requirement for being potentially economic, as it generated a negative net present value. Thus, a pit-constrained mineral resource could only be reported for the PQ mineralized zone. This leaves Lodestar with a significant opportunity to expand and build upon the established resources at the Peñasco Quemado property: Further drilling in and around this area may be able to enlarge the existing PQ mineral resource, and this would assist in potentially bridging the gap between the two detached mineralized zones and increasing the resource potential beyond the extent of the current pit shell.

Micon’s QPs have conducted an independent review of the exploration potential of the Peñasco Quemado Project, using historically available information and discussions with Lodestar personnel.

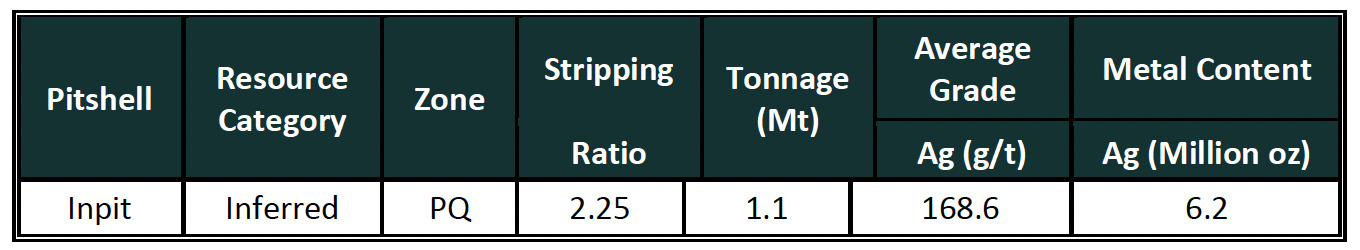

Table 1: Mineral Resource Estimate for the Peñasco Quemado Project at 85 g/t Ag Cut-off as of March 21, 2023

Notes:

- The effective date for the Peñasco Quemado Project mineral resource estimate is March 21, 2023.

- The mineral resources are reported based on open-pit mining method scenarios.

- The pit was constrained based on a bench slope of 30° for the overlying alluvium and 45° for the remaining lithologies.

- The mineralized wireframes (PQ zone) within which the resources are contained were modelled on a cut-off silver grade of 25 g/t.

- Grade capping was applied to reduce the influence of outlier samples, and a cap of 460 g/t silver was applied for the PQ zone.

- The economic parameters used to define mineral resources are a metal price of USD25 per troy ounce of silver, a mining cost of USD2/t, a processing cost of USD40/t and a G&A cost of USD5/t, for a total of USD47/t mined and processed. The silver recovery was estimated at 69%.

- The resource is estimated for silver only, as manganese is not recoverable into a salable product for Peñasco Quemado Project.

- The entire mineral resource has been categorized in the Inferred category.

- The mineral resources presented here were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council on May 10, 2014.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. Therefore, the QP believes that, at this time, the mineral resource estimate is not materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant issues. However, as the Peñasco Quemado Project advances, further required studies in these areas or other socio-political factors may affect the resource estimate.

- The mineral resource estimate has been prepared without reference to surface rights or the potential presence of overlying infrastructure.

- Figures may not total due to rounding.

Figure 1: 3D Perspective of the Peñasco Quemado Project Drill Hole Locations and the Two Mineralized Envelopes

Figure 2: 3D Perspective of the PQ Mineralized Zone Block Model, also showing the area of Pit -Constrained Resources

Data Validation

The 2023 MRE considered drilling information up to and including the most recently completed program in 2019, as well as geological information from previous work programs completed at the property. A total of 138 drill holes have been completed on the property. Drilling data supporting the 2023 MRE includes information from historic drilling data from 97 holes, a total of 1548 samples for 1,956m at PQ main zone, and 57 samples for 84.5 m at the PQ south zone contribute to the MRE. Nominal drill hole spacing is approximately 50 x 100 m within the inferred portions of the 2023 MRE. Verification of drilling exploration data used for the 2023 MRE was performed by William J. Lewis, B.Sc. P.Geo. (Micon), an independent Qualified Person.

Sensitivity Analysis

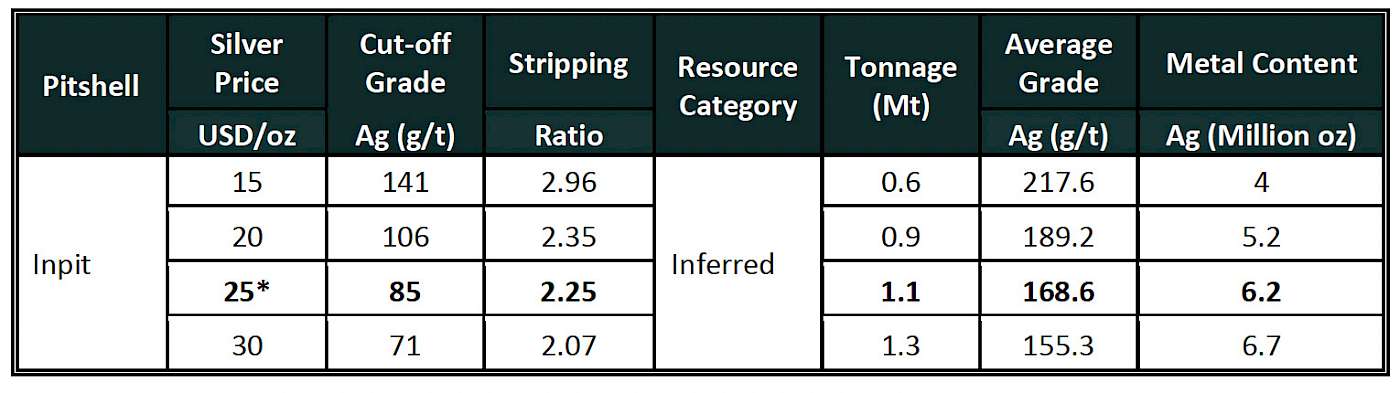

Micon’s QPs have performed a resource sensitivity analysis for the PQ zone, based on a silver price range from 15 USD/oz to 30 USD/oz, with an increment of every 5 USD. Different silver prices correspond to different cut-off grades. Other economic parameters (mining and processing cost, G&A cost, and silver metallurgical recovery) remain unchanged. Table 1.4 summarizes the result of this analysis. The reader is cautioned that the figures provided in Table 1.4 should not be interpreted as a mineral resource statement. Instead, the reported quantities and grade estimates at different silver prices and cut-off grades are presented to demonstrate the mineral resource's sensitivity to variations in the price of silver. Micon’s QP has reviewed the sensitivity study and believes that the results meet the requirements to demonstrate potential economic extraction at the silver prices used.

Table 2: Silver Price-based Mineral Resource Sensitivity for the Peñasco Quemado Project. Source: Micon, 2023.

*Peñasco Quemado 2023 base case Mineral Resource Estimate.

The updates made to the resource calculations can be attributed to several key factors. Firstly, an updated block model was implemented to replace the original polygonal method, which was deemed less accurate. Secondly, the reclassification of the resources was largely due to the historical nature of the drilling, necessitating a re-evaluation of the data. Finally, changes in the CIM Standards and Definitions since the previous mineral resource estimate was disclosed also significantly influenced the updated calculations.

Cut-Off Grade and Reasonable Prospects for Eventual Economic Extraction

The base-case COG (85 g/t silver) was determined using the following assumptions:

- Silver price of US$25.0 per troy ounce;

- Processing costs of US$40 per short ton;

- General and administrative costs of US$5 per short ton;

- Mining costs of US$2.0 per short ton; and

- Silver recovery of 69%

Metal recoveries are based on preliminary results from the 2012 Metallurgical Test Program completed by Silvermex and is consistent with recoveries for comparative operations. Silver price was calculated by averaging the price from the last 12 months up to March 1st, 2022. Changes in metal prices, optimized processing parameters and/or improved metal recoveries will all impact COGs and any resultant MRE. Economic pit shell utilizing a bench slope of 30° was used for the overlying alluvium, and a slope of 45° was used for all other lithologies.

About the Peñasco Quemado Property

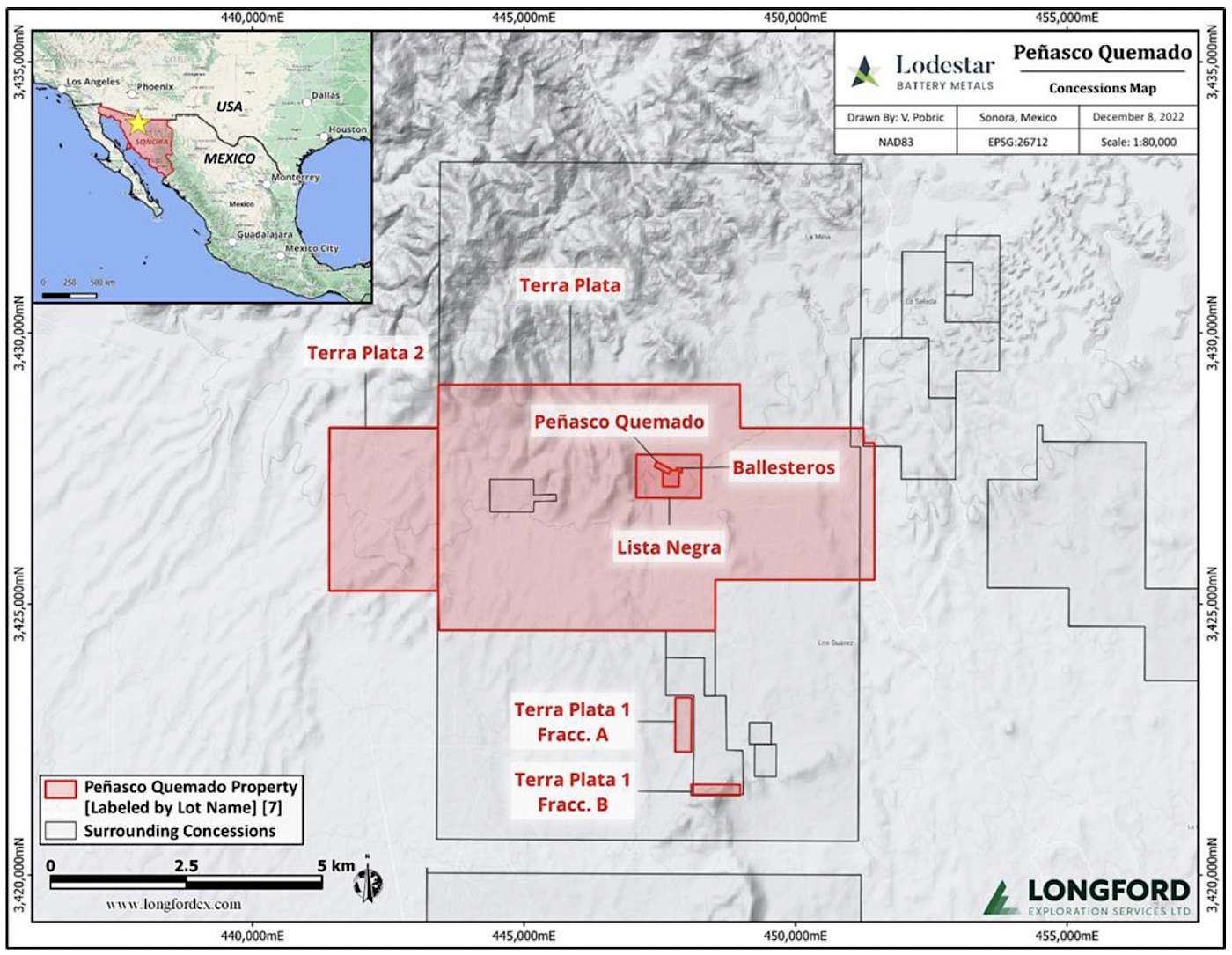

The Peñasco Quemado Project is located in the Mexican state of Sonora, south of the American state of Arizona. Specifically, the Project is located within the north-central portion of Sonora, approximately 14.5 km northwest of the town of Tubutama and in the Magdalena-Tubutama mining district.

Figure 5 Location and claims outline of the Peñasco Quemado property

The Peñasco Quemado property is extensively covered by a cap of alluvium and valley fill which varies from 0 to 40 m thick. The alluvium and fill overlie the Pit (Volcaniclastic) Conglomerate (formerly named the Red Conglomerate) and the Upper conglomerate, which is up to 200 m thick, as evidenced by drill hole intersections. The Pit (Volcaniclastic) Conglomerate is in a high-angle fault contact with a volcanic sequence that includes andesite tuffs, andesite breccia and andesite flows. The entire upper lithological column unconformably overlying a basement of gneissic granite. Between the two units, there exists a complex unit that has been described by the geologists of Silvermex/Terra Plata as felsite. The felsite is associated with a mylonite zone that has been identified along a strike distance of several kilometers from the western portion of the property, where it outcrops in the areas called the Low Angle, The Pink Breccia and the Stockwork. In the Peñasco pit area, mylonite has been encountered up to 130 m to 150 m deep in the drill holes.

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by William J. Lewis, P.Geo., Chitrali Sarkar, M.Sc, P.Geo., both of Micon and Rodrigo Calles-Montijo, CPG, AIPG., of Servicios Geológicos IMEx, S.C. All are Qualified Persons independent of the Company. All are Independent Qualified Persons as defined by National Instrument 43-101 Standards for Disclosure of Mineral Projects.

The mineral resource estimate was produced in conformance with the Canadian Institute of Mining Metallurgy and Petroleum (“CIM”) “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and is reported in accordance with NI 43-101. The Waterloo mineral resource estimate has an effective date of February 8, 2023. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve.

This news release has also been reviewed and approved by Luke van der Meer, P.Geo, an consultant for the Company and an Independent Qualified Person as defined by National Instrument 43-101 Standards for Disclosure of Mineral Projects.

Update to Lodestar Leadership

Effective immediately, Lowell Kamin holds the positions President, CEO & Chairman of the Board, (previously CEO & Director), to better reflect Mr. Kamin’s roles and responsibilities with the Company. In addition, Director Scott Margach has been appointed Executive Vice President & Director to better reflect his role with Lodestar.

About Lodestar Battery Metals Corp.

Lodestar Battery Metals Corp. is a Canadian mining exploration company focused on the battery metals space. The Company’s 100% owned flagship Peny Property comprises 47 mineral claims totaling 11,191 hectares in the Snow Lake District, Manitoba, with access to tier-1 existing infrastructure: railway, roads, airstrip, and power. The Company also owns 100% interest in two significant silver assets in Mexico. The Company intends to build a strong portfolio of battery metals projects to drive future growth through exploration success and from later-stage projects with production potential. The Lodestar business plan calls for a dynamic combination of developing its existing properties, acquisitions, and partnerships to achieve this growth. For more information, visit https://lodestarbatterymetals.ca/.

Contact

Lodestar Battery Metals Corp.

Lowell Kamin, President, CEO & Chairman of the Board

(416) 272-1241

ac.slatemyrettabratsedol@llewol

Investor Relations

Alyssa Barry, IR Labs Inc.

1-833-947-5227

ac.slatemyrettabratsedol@srotsevni

Forward-Looking Statements

The information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions, and expectations. They are not guarantees of future performance. Lodestar cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond Lodestar's control. Such factors include, among other things: risks and uncertainties relating to Lodestar's limited operating history and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.