Silverton Metals Corp. Announces Commencement of Drilling at its Penasco Quemado Project, Sonora, Mexico

November 3, 2021VANCOUVER, BC, November 3, 2021 – Silverton Metals Corp. (TSX-V: SVTN, OTCQB: SVTNF) ("Silverton" or the "Company") is pleased to announce it has commenced a 2,200-meter diamond drilling program on its 100% owned Peñasco Quemado ("PQ") project located in northern Sonora, Mexico. The drilling will test two priority target areas called La Fortuna and Penasco Pit, located in separate areas of the property.

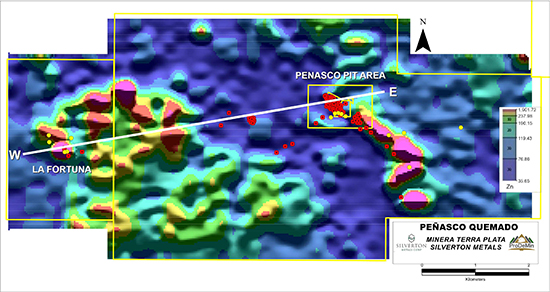

In the Penasco Pit area, on the eastern part of the property, the drilling will target the south and southeast, down-dip extension of a conglomerate-hosted, shallow, southwest-dipping replacement manto that contains the drill defined historic resource estimate (Table 1). Additional drilling is designed to test the interpreted along-strike extensions to this mineralized zone area as identified by strong, southeast-trending geochemical anomalies (zinc, lead, barium and manganese in soils) which exceed three kilometers in length and have some coincidental geophysical anomalies (Fig. 1).

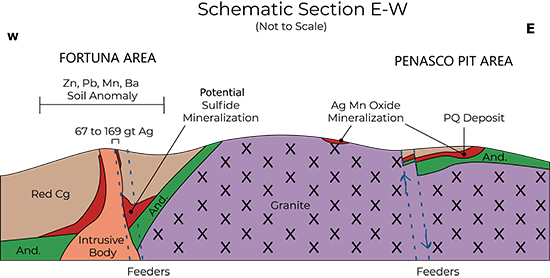

Drilling in the Fortuna area, on the western part of the property, will test strong zinc, lead and copper soil anomalies with a coincidental "plug" like geophysical low resistivity anomaly that extends beyond 500 meters in depth. Company geologists interpret this geophysical anomaly as altered intrusive rocks which may be a potential source of mineralization. Historic drilling in this area intersected significant silver values (340g/t Ag over 4.5m and 113g/t Ag over 4.5m in holes PQRC51, and PQRC49 respectively) within northwest-oriented, east-dipping vein structures adjacent to an andesitic dyke traced for a length exceeding 700 meters. The mineralization in this target is open along strike and at depth. Conceptually there is potential for manto style mineralization in conglomerates as well as skarn at the interpreted contact between the plug and conglomerate rocks (Fig 2).

John Theobald, President and CEO commented; "We are pleased to commence this initial phase of drilling to test the continuity of the mineralization along strike and at depth in both the Penasco and Fortuna areas of the project. It is worth noting that the historic resource estimate is confined to the Penasco Pit area and, subject to results of the initial drilling, a second drilling phase will be conducted with the aim of expanding the deposit. We note some geological similarities between Penasco Quemado and the Hermosa-Taylor zinc, silver, lead and manganese deposit, located approximately 100 km northeast of Penasco Quemado, in Arizona".

About Peñasco Quemado

Peñasco Quemado is a 3,746-hectare property located in northern Sonora, 60 kilometres south of the town of Sasabe on the US-Mexico border. A 2006 drilling program outlined a historical measured and indicated resource of 2.57 million tonnes at a grade of 117 g/t silver for a silver historic measured and indicated resource of 9.63 million ounces (see below). The silver mineralization is associated with manganese and barium oxides in a near surface shallow westerly dipping zone of volcaniclastic rocks formerly called polymictic conglomerate.

Figure 1. Penasco Quemado drill hole map showing programmed holes in yellow, historic holes in red, on the zinc soil geochemistry map. Section W-E is shown in Figure 2.

Figure 2. Conceptual Schematic section illustrating the manto extension and Fortuna targets on Penasco Quemado

Historic Resources

Silvermex Resources Limited reported in a technical report titled "Updated NI 43-101 Technical Report and Resource Estimate for the Penasco Quemado Silver Property" dated March 9, 2007 (filed on SEDAR on March 16, 2007), prepared by William J. Lewis and James A. McCrea, the above referenced historical mineral resource estimate. Accordingly, Silverton considers these historical estimates reliable as well as relevant as it represents a target for exploration work by Silverton. The historical resource estimate is set out in detail below:

Table 1. Penasco Quemado historic resource estimate.

|

RESOURCE CATEGORY |

MINERALIZATION TYPE |

TONNES |

Ag |

Ag |

|

Measured |

Oxides |

0.12 |

152 |

0.60 |

|

Indicated |

Oxides |

2.44 |

115 |

9.03 |

|

Total M + I |

Oxides |

2.57 |

117 |

9.63 |

|

Inferred |

Oxides |

0.10 |

41 |

0.13 |

*The data base for the historical resource estimate consisted of 24 reverse circulation holes from a 1981/82 program, 17 reverse circulation holes from a 2006 program and 8 diamond drill holes from a 2006 drill program. Assay data was available for all 49 of the drill holes and 12 trenches. The mineral resource estimate used a kriging estimation method to establish ore zones with a cut-off grade of 30 g/t Ag and assay's capped at 700 g/t Ag. Resource blocks were estimated by ordinary kriging with samples within a search radius of 25 meters classified as a measured mineral resource, within 47 meters classified as an indicated mineral resource and within 70 meters classified as an inferred mineral resource. As required by NI 43-101, CIM definitions (August 2004) were used to classify mineral resources with the classification of each kriged ore block dependent upon the number of penetrating holes. An in-situ block density of 2.50 t/cu meter was assigned the ore blocks. The qualified person has not done sufficient work to classify the historical estimate as a current mineral resource. Silver One is not treating this historical estimate as current mineral resources.

La Frazada Permitting

The Company has been informed by Mexico's Secretaría del Medio Ambiente y Recursos Naturales ("SEMARNAT") that the Informe Preventivo report needed to conduct surface drilling has not been approved and that the Company will be required to submit and have approved an Environmental Impact Statement ("EIS") before drilling can commence. It is estimated this process will take about six months. Exploration will be halted temporarily until the EIS has been prepared and approved.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Peter Born, P. Geo., a Qualified Person for the purpose of NI 43-101.

On behalf of the Board

John Theobald

President, CEO & Director

Silverton Metals Corp

About Silverton Metals Corp

Silverton Metals Corp is a Canadian company focused on the exploration and development of quality silver projects. The company holds a 100% interest in three significant silver assets in Mexico – Pluton, in Durango, Peñasco Quemado in Sonora and La Frazada in Nayarit. Silverton management and board have extensive experience identifying and evaluating acquisition targets and exploration prospects. The company intends to build a strong portfolio of silver and gold-silver projects to drive future growth by exploration success and from later stage projects with production potential. To achieve this growth the Silverton business plan calls for a dynamic combination of development of its existing properties, acquisitions, and partnerships.

For further information please contact:

Silverton Metals Corp.

W. Barry Girling, VP Corporate Development and Director

(604) 683-0911

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Silverton cautions that all forward looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond Silverton's control. Such factors include, among other things: risks and uncertainties relating to Silverton's limited operating history and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Silverton undertakes no obligation to publicly update or revise forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.